is the interest i paid on my car loan tax deductible

While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest. In many cases the interest you pay on personal loans is not tax deductible.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

However you may be able to take a tax deduction if you use the loan for certain specific purposes and meet all the eligibility requirements.

. Read on for details on how to deduct car loan interest on your tax return. You can deduct your loan interest on the mortgage loan on the first 750000 you took out on Oct. But there is one exception to this rule.

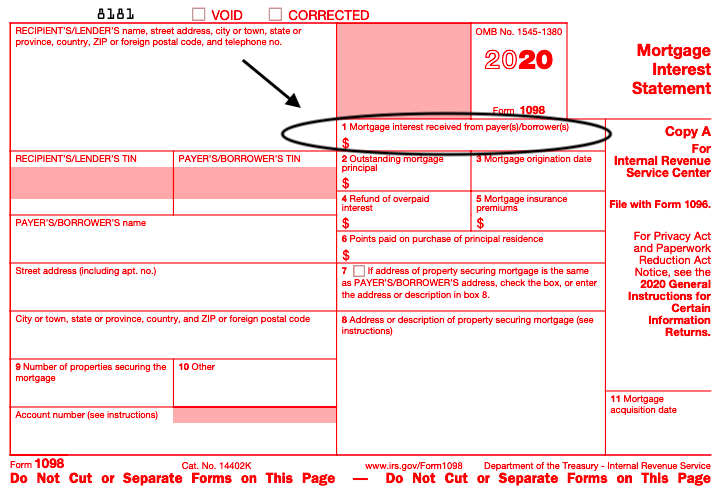

The form spells out the total amount of interest paid to the lender during the tax year. You might pay at least one type of interest thats tax-deductible. You can deduct the interest paid on an auto loan as a business expense using one of two methods.

Why is debt interest tax deductible. Car loan interest is tax deductible if its a business vehicle. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Types of interest not deductible include personal interest such as. Also interest paid on a loan used to purchase a car solely for personal use is not deductible.

It can also be a vehicle you use for both personal and business purposes. Typically deducting car loan interest is not allowed. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit.

Interest paid on personal loans car loans and credit cards is generally not tax deductible. But there is one exception to this rule. So you must keep careful records of the percentage of time the car is driven for each purpose.

This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction. In this case neither the business portion nor the personal portion of the interest will be deductible. Now the one thing to keep in mind is that the amount you can deduct is based on how much the vehicle is used for business versus personal purposes.

Who can deduct car expenses on your tax return. You must report your tax-deductible interest to the IRS and this invariably means filing additional. Can you deduct car loan interest on your taxes.

The expense method or the standard mileage deduction when you file your taxes. Reporting Requirements for Loan Interest Income To report this income the borrower who pays the interest completes a Form 1099-INT and submits one copy to the lender and one to the IRS. Typically deducting car loan interest is not allowed.

Interest on car loans may be deductible if you use the car to help you earn income. Come tax time you may deduct the percentage of your car loans interest associated. You cannot deduct a personal car loan or its interest.

SBA guarantee fees arent tax deductible because theyre designed to transfer the cost of an SBA small business loan from taxpayers to businesses who depend on government funding. You normally cannot deduct your car loan interest payments. Are SBA loan fees tax deductible.

Unfortunately car loan interest isnt deductible for all taxpayers. Generally interest expenses are not considered banking fees however these costs may still be deductible. A taxpayer takes out a loan secured by his rental property and uses the proceeds to refinance the rental loan and buy a car for personal useThe taxpayer must allocate interest expense on the loan between rental interest and personal interest for the purchase of the car and even though the loan is secured by the business property the personal loan interest.

We use cookies to give you the best possible experience on our website. The good news is. Personal use is not deductible.

Car loan interest is tax deductible if its a business vehicle You cannot deduct the actual car operating costs if you choose the standard mileage rate. If on the other hand the. If you use your car for business purposes you may be able to deduct actual vehicle expenses.

Is the interest you pay on a car loan 1098 INTPaid deductible annually on an income tax return only the year the - Answered by a verified Tax Professional. But you can deduct these costs if its a business car. The interest on a car title loan is not generally tax deductible.

But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file. This is because the only interest that is still deductible as an itemized deduction is home mortgage interest and investment interest. None of the interest will be deductible.

According to our model if you received a 900000 mortgage in 2017 and paid 25000 as interest for that same loan during 2021 and filed your tax return under that loan during 2021 then you should have deducted all of that interest. Is interest on car loan tax deductible. The faster you pay off your car title loan the less you will pay in interest.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. If you use your car for business purposes you may be able to deduct actual vehicle expenses. But you cant just subtract this interest from your earnings and pay tax on the remaining amount.

If the vehicle in question is used for both business and personal purposes claiming this tax deduction is slightly more complicated. If the vehicle is entirely for personal use. While typically deducting car loan interest is not allowed there is one exception to this rule.

Interest on loans is deductible under CRA-approved allowable motor vehicle expenses. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. How do I report interest income from a business loan.

Interest paid on a loan to purchase a car for personal use. Credit card and installment interest incurred for personal expenses. The same is valid for interest payments on your business credit card business line of credit business car loan or any loan youre taking out exclusively for a business expense.

Should you use your car for work and youre an employee you cant write off any of. The standard mileage rate already factors in costs like gas taxes and insurance.

80tta 80ttb Deduction In Respect Of Interest On Deposits In Savings Account Income Tax Deduction Income

Public Provident Fund In 2021 Public Provident Fund Tax Saving Investment Safe Investments

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Car Payment

Tax Deductions For Home Mortgage Interest Under Tcja

Studentdebtcrisis Debtcrisisorg Student Debt Student Loan Interest Repay Loan

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

When Is Interest On Debt Tax Deductible

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Business Tax Small Business Tax Business Tax Deductions

Learn How The Student Loan Interest Deduction Works

House Property Income Tax Refund

Is Personal Loan Interest Tax Deductible Experian

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

Is Buying A Car Tax Deductible In 2022

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Quickbooks Self Employed Review 2022 Carefulcents Com Quickbooks Small Business Accounting Online Taxes

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

Handy Printable Tax Prep Checklist Tax Prep Checklist Small Business Tax Tax Prep